Banks are not and have never been our fren.

https://www.youtube.com/watch?v=mjMFwewWVMA

Jesus is my Savior. Love my husband & America. Dog lover. RN. Constitutional conservative. Love Trump. Followed by Flynn and VK on Twitter.

Just guessing here, but a default is what may be needed to reset the whole financial mess with a new gold back currency? 🤔

Nana, Direct Internal connection to God, WWG1WWA, MAGA, Angels are here already #FightLikeGodIsBesideYou

Nana would agree that some sort of default will have to happen to change over the system but we will not, imho, see the dollar destroyed.

Number one, Juan, whom I understand to be closer to Trump and the Q team than anyone else on the planet, has said as much that the dollar will not be destroyed that the ONLY REAL constitutionally authorized monetary system is one backed by Gold and Silver.

Nana agrees with this.

Number two, there is NO FOOKN WAY that the Q team and Trump have gone thro all of this, some of them for literally DECADES of planning and executing life threatening events to destroy our nation TOTALLY or to the point that other countries like China or Russia could swoop in and take us over or to a degree that it would take us years to recover.

Think about it, that would be insane, but to what degree and what losses, idk.

May you trust God that you are exactly where you are meant to be. May you not forget the infinite possibilities that are born of faith.

I am a Information Treasure Hunter. I was sent to earth to teach Love and Kindness

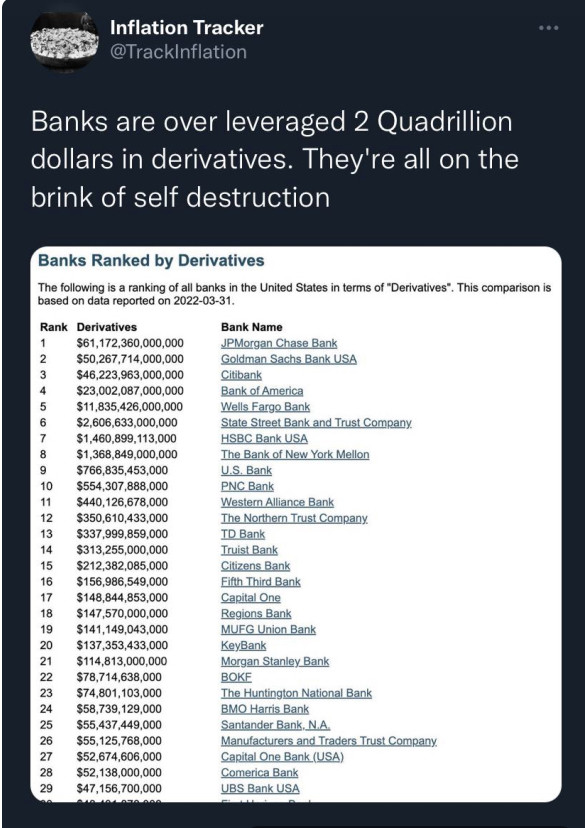

What Is a Derivative?

The term derivative refers to a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark. A derivative is set between two or more parties that can trade on an exchange or over-the-counter (OTC).

These contracts can be used to trade any number of assets and carry their own risks. Prices for derivatives derive from fluctuations in the underlying asset. These financial securities are commonly used to access certain markets and may be traded to hedge against risk. Derivatives can be used to either mitigate risk (hedging) or assume risk with the expectation of commensurate reward (speculation). Derivatives can move risk (and the accompanying rewards) from the risk-averse to the risk seekers.