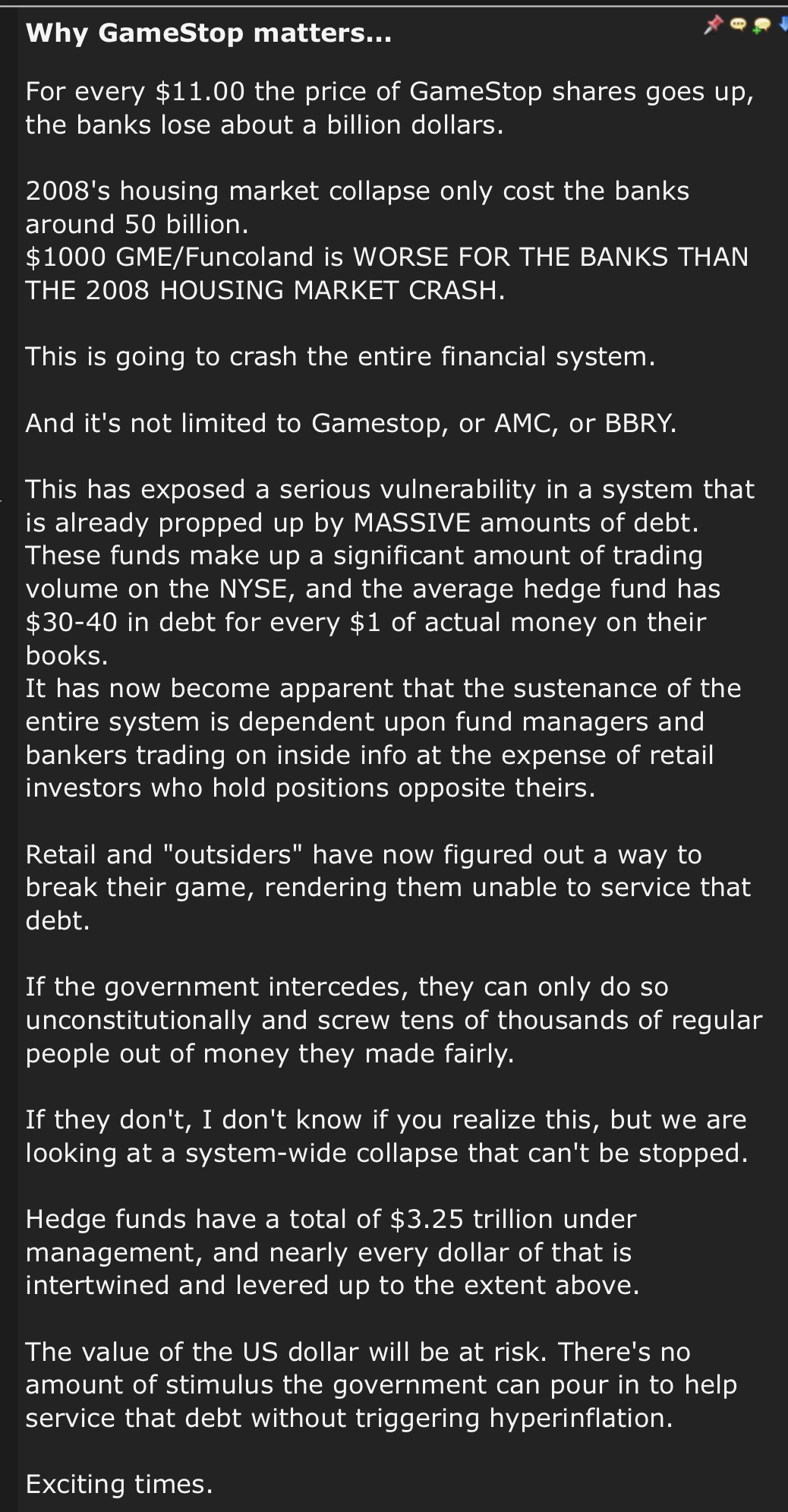

while there are kernels of truth in this diatribe, there is also misinformation. the average hedge fund is not levered 30x. false. maybe 2x. exposure of banks to this short squeeze is secondary as quant funds and hedge funds are forced to unwind these positions, they may also be selling their longs. all in all, I disagree that this is a systemic risk. I do agree that there should be zero bailouts of funds caught up in this.