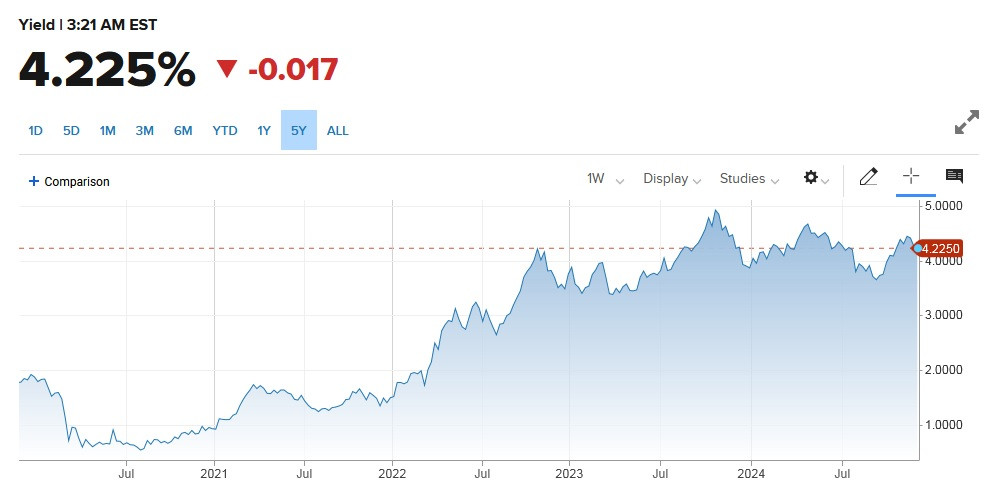

Banks are in trouble right now because the bond market remains inverted so they can not lend money out. If the US 10Y hits 5,0%, we will most probably have a melt down. It hit 4.92% last year with the UK 10Y Gilt and it forced the BOE to come out on TV and told investors to eat the loss, you are getting no help. I believe this was a test run to find the breaking point. Remember bond yeild goes up, bond price go down so they lose their collatoral and the banks get margin called. From what I can see in the market at the moment is the Fed is buying its own debt to suppress rates, when they are told to stop, it will be a Lehmann Bros moment on steriods. The markets dont decide when its over "they" do.