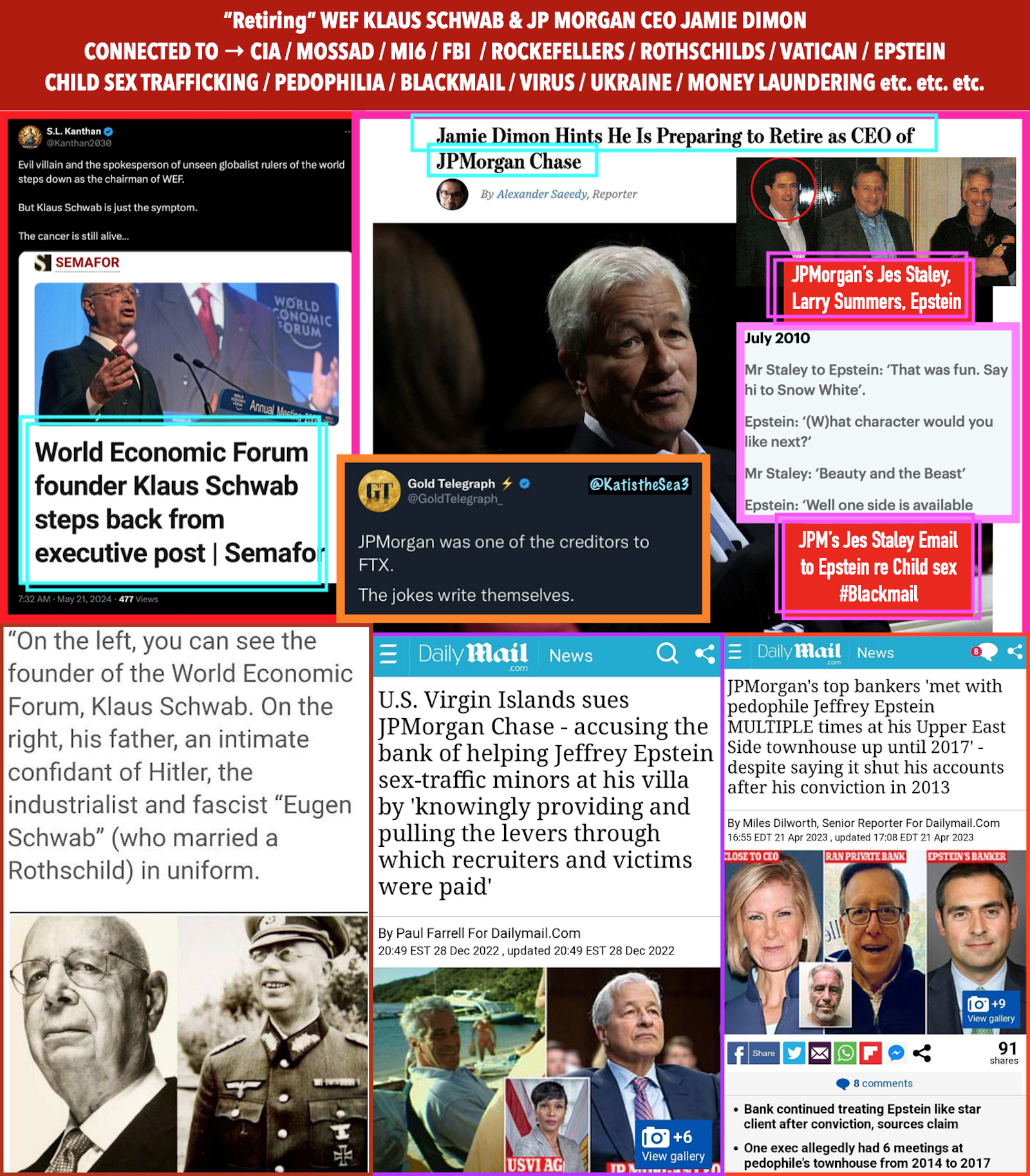

Two evil deep state monsters are “resigning” [already gone 💥]

Klaus Schwab, co-founder WEF

& Jamie Dimon, CEO JP Morgan

👇 ICYMI

🇺🇸 4-21-24 @ qthestormrider777

“The Rothschild's. Rockefellers all come from

Germany where the Illuminati was created in 1776

& where Klaus Schwab comes from .....

They were all created by the Kazarians

who created the fake Jewish people

in agreement with Roman empire

to rename Kazarians to Jewish people..

These certain Kazarian Jewish people that moved through Germany

were called the AshkeNAZI Jews.”

“Jamie Dimon most Powerful banker on Wall Street

→ CIA. WORLD BANKS. INTEL communities

→ [EPSTEIN] [EPSTEIN] [EPSTEIN] [EPSTEIN]

Dimon is a central KEY on how

THE DS TOOK CONTROL OF THE WORLD…

JP Morgan allowed EPSTEIN to run sex trafficking networks

through their banking system…

EPSTEIN was placed by the CIA/MOSSAD/MI6 DS alliance…

BLACKMAIL OPS THAT INCLUDE

THE ROCKS, ROTHS, VATICAN… pedophilia, sex trafficking"

knock it off with your lies!

Dimon's 'comment' about a succession plan was an answer to valid shareholder concerns. Chase bank is projecting better Net Interest Income on larger than {other banks} Equity. Investors want assurances that Chase will continue to be managed as well beyond 2026

For Humanity's Liberation & 'till every Child is rescued & out of harm's way. 2 ancestors fought under General Washington. Trump! MAGA!

Let's revisit the whole Central Banking balance sheet thingamgiggie after the $2.5+ derivatives that even Warren Buffet used to call "financial weapons of mass destruction" gets factored in. (EO 13818 might also come into play somewhere in there meantime). Not sure on the exact number of total "derivative" liabilities out there, cuz it's just all so murky, and besides, my mind just can't quite grasp what a "quadrillion" really is. Thought I'd try out this graphic to help me get my head around it...

well,.. Warren Buffett is NOT the person to claim any expertise beyond branding.. BUT,.. to your point Chase is NOT a Central Bank. There are many different types of derivatives. Commodity Futures are just a derivative. I'm sure you are not seriously suggesting 'we' outlaw something 'cause it sounds dangerous. Derivatives are an effective Hedge to mitigate risk... in this case interest rate risk and Chase Bank is REALYY good at it. Hence, lowering risk, especially the more important risk of greater volatility of interest rate risk is better (and safer) business.

Seein' how 2008 was in a large part a collapse of only the fake insurance (Credit Default Swaps) on the derivatives and not the derivatives themselves, I think what's coming is probably gonna make 1929 look like a baby's hiccup. My opinion only.

Fraud's running so rampant these days people think it's legit. That's a fact.

It's also my opinion that yes, all derivatives should be (and should have stayed) outlawed as they were after 1933 Glass Steagall (thanks to what "bucket shops" did to contaminate pre-Great Depression markets), but this time OUTLAWED with real enforcement with very big sharp teeth and handcuffs at the ready.

Nothing Can Stop What Is Coming.

Let's revisit in a year or two and see what happens.