Companies who give 1099 also pay by PayPal and Zelle so those will get 2 1099s. This is going to cause a major gridlock to IRS because this will happen for nearly every self-employed person. Nobody will pay for the same income on 2 separate 1099s

MAGA Patriot whose life has been turned upside down in recent days. The support and kindness I get here is incredible. Thanks, frens.

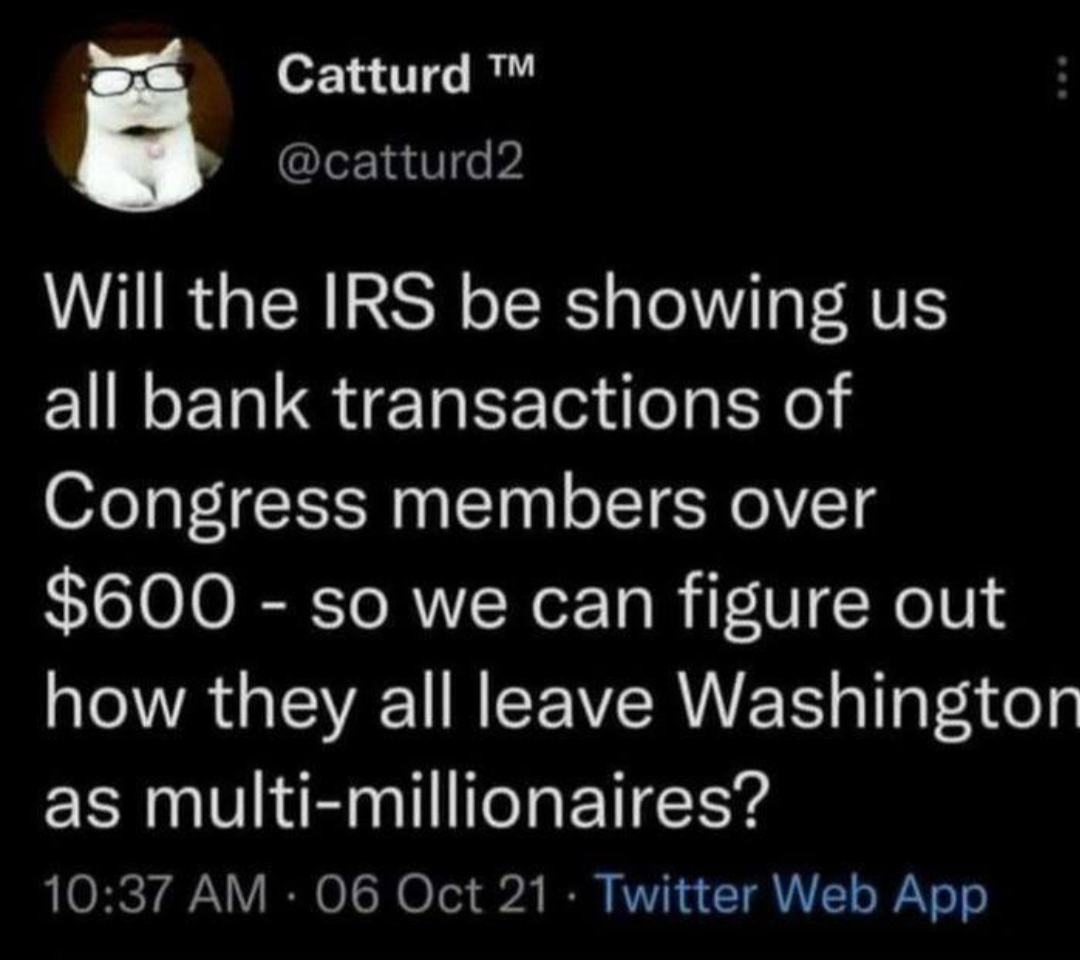

There's been a steep decline over the past few years in the number of Americans paying income tax. I'm guessing many people, me included, felt angry that they were being forced to lock down and either lost their small business or suffered a cut in pay due to lost wage hours. Nothing was being done to help the middle class outside of the pitifully small PPE checks. At that point, the prevailing attitude is, "Fuck the federal government! What have they done for me besides make it harder to earn a living?" So we stopped filing a 1040.

And guess what? The 1040 tax form is an acknowledgement to the IRS that you owe them taxes. And when you sign the form, you're making yourself liable to pay the amount that your calculations say that you owe.

Without your signature on the form, the IRS can't do anything to force you to pay. In other words, paying income tax is strictly voluntary.

Californian Patriot!! Love my family, country, and all patriots. God Bless. #TrumpIsStillMyPesident

Are you sure about this.....how come they charge interest if you don't pay your income tax on time???