Mark Thomas

@markthomasNotice: Undefined index: user_follows in /home/admin/www/v2.anonup.com/themes/default/apps/profile/content.phtml on line 273

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Mitigate Regulatory Compliance Risks with Automated Claims Software

Automation creates standardized processes that maintain consistent regulatory adherence across all claims operations. Insurance claims processing software establishes detailed audit trails that document every decision point, protecting against compliance violations. This systematic approach minimizes exposure to legal challenges that often result from inconsistent claims handling practices, reducing potential penalties and litigation costs.

Read More - https://www.techsling.com/preventing-costly-revenue-leakages-for-insurers-with-automated-claims-processing-software/

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

How Digital Transformation Drives Growth for Insurers in 2026

Explore the role of digital transformation in driving insurer growth, enhancing customer experience, improving operational efficiency, and enabling data-driven decision-making in the evolving insurance landscape. Digital technologies are helping insurers streamline processes, innovate products, and stay competitive.

Read More - https://www.damcogroup.com/blogs/role-of-digital-transformation-in-driving-insurer-growth

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Speed Up Reinsurance Processes with Automated Solutions

The shift from paper-based systems to digital platforms changes how insurance companies manage their reinsurance programs. Staff members previously burdened with repetitive data entry and manual calculations can redirect their expertise toward analysis and strategic decision-making. Companies that embrace reinsurance automation solution for insurance gain a competitive edge through faster processing times, reduced error rates, and enhanced risk management capabilities.

Read More—https://writeupcafe.com/tackling-reinsurance-complexities-with-process-automation-solutions

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

How Automation Is Transforming Insurance Claim Processing Operations

Insurance claim processing is often slowed by manual workflows, data inconsistencies, and operational bottlenecks. This blog explores how intelligent automation helps insurers overcome these challenges by accelerating claim cycles, improving accuracy, reducing costs, and delivering faster, more transparent customer experiences.

Read More—https://www.damcogroup.com/blogs/overcoming-claim-processing-challenges-with-automation

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Drive Business Success with Modern Insurance Agency Software

Discover how modern insurance agency software transforms operations by streamlining workflows, strengthening compliance, enhancing customer engagement, and accelerating sustainable growth. This blog highlights the essential capabilities that empower agencies to make smarter, data-driven decisions and confidently embrace digital evolution.

Read More - https://www.damcogroup.com/blogs/drive-business-success-with-modern-insurance-agency-software

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Deliver Personalized Insurance Services with Underwriting Software

The unified architecture of modern underwriting platforms transforms isolated data into actionable business insights. Insurance organizations who implement insurance underwriting software gain the capability to deliver personalized services that align with individual customer requirements. Personalization encompasses tailored risk assessments, dynamic pricing models, and flexible coverage designs that reflect actual customer circumstances rather than broad market categories.

Read More - https://crweworld.com/usa/nj/plainsboro/localnews/tech/3781997/intelligent-underwriting-software-how-it-delivers-personalized-insurance-services

Crwe World | Intelligent Underwriting Software: How It Delivers Personalized Insurance Services

Insurance underwriters battle daily with fragmented systems that waste their time searching for information instead of using their expertise. These professionals waste most of their time on administrative tasks rather than ev

https://crweworld.com/usa/nj/plainsboro/localnews/tech/3781997/intelligent-underwriting-software-how-it-delivers-personalized-insurance-servicesMark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Enhance Regulatory Fulfillment Effectiveness with Compliance Management Software

Insurance companies that embrace compliance automation position themselves for long-term success. While regulatory requirements will continue to evolve, businesses equipped with modern compliance tools can adapt quickly and efficiently. The investment in insurance compliance management software delivers returns through reduced operational risks, improved audit readiness, and enhanced regulatory relationships.

Read More—https://completemarkets.com/Article/article-post/2795/Shifting-to-Smart-Regulatory-Change-Management-with-Insurance-Compliance-Solutions/

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

How Best P&C Insurance Software Helps Small Carriers Digitize and Compete

Small property & casualty insurers often struggle with legacy systems, limited IT budgets, and manual processes. The right P&C insurance software enables them to automate key functions like policy admin, claims handling, billing, and analytics, helping them boost productivity, reduce errors, and deliver seamless digital customer experiences without large infrastructure costs. Modern solutions also support cloud deployment, API-first integrations, and advanced risk insights to strengthen competitiveness.

Read More - https://www.linkedin.com/pulse/how-best-pc-insurance-software-enables-small-sized-carriers-alice-leo-dslwe/

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

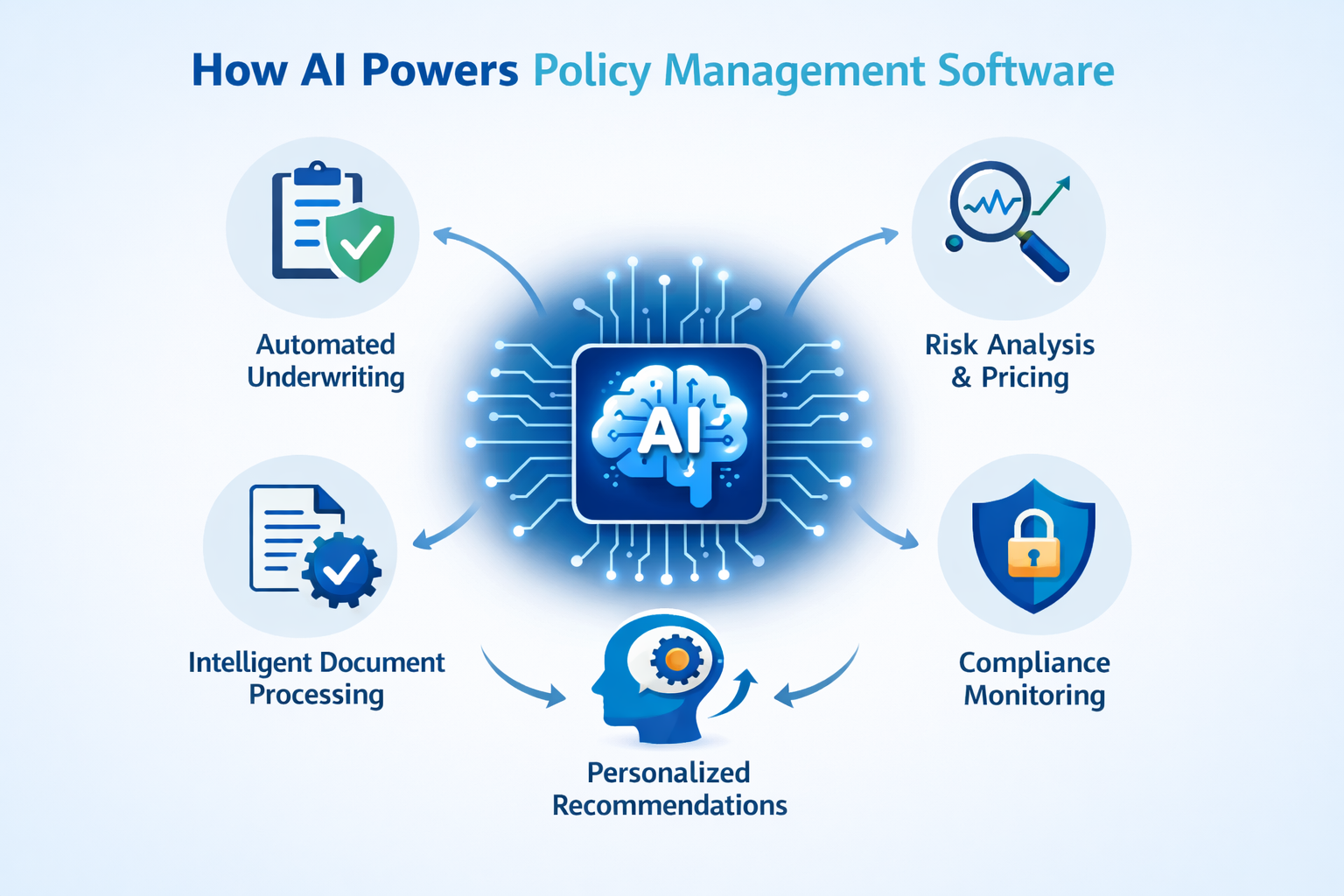

How AI Is Redefining Policy Management Software

AI is rapidly redefining policy management software by introducing intelligent automation, advanced data analytics, and real-time decision support across the policy lifecycle. This article examines how AI-driven capabilities help insurers streamline policy issuance, endorsements, renewals, and compliance, while reducing manual effort and operational risk. It also highlights how modern insurers are using AI to improve accuracy, scalability, and customer experience in policy administration.

Read More—https://www.insurancethoughtleadership.com/ai-machine-learning/ai-revolutionizes-policy-management-software

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Strategic Guide to Policy Administration Transformation for Modern Insurers

Unlock the future of insurance operations with our comprehensive guide to policy administration transformation. Learn how modernizing legacy systems improves efficiency, compliance, and customer experience while enabling scalable, data-driven decision-making for insurers. Discover key strategies, essential tech features, and metrics to measure success.

Read More—https://www.damcogroup.com/blogs/strategic-guide-for-policy-administration-transformation

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Streamline Legacy Insurance Operations with Policy Administration Software

Legacy insurance operations relied heavily on manual processes for policy administration, claims processing, and customer service. These manual workflows created bottlenecks that slowed service delivery and increased operational costs. GenAI-powered insurance policy administration software automates routine administrative tasks while maintaining accuracy and compliance standards. These platforms streamline workflows for document generation, policy renewal notifications, and preliminary underwriting assessments.

Read More—https://vocal.media/journal/generative-ai-in-insurance-policy-management-systems-enabling-personalized-services

Generative AI in Insurance Policy Management Systems: Enabling Personalized Services | Journal

Personalize Policyholder Experiences with Smart Policy Administration Solutions

https://vocal.media/journal/generative-ai-in-insurance-policy-management-systems-enabling-personalized-servicesMark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

The Reality of Claims Experience in Healthcare Insurance

The claims experience is a defining moment for healthcare insurers. Delays, lack of transparency, and complex processes quickly erode customer trust. Modern healthcare claims processing software addresses these challenges by streamlining workflows, improving visibility, and accelerating claim resolution. Delivering fast, clear, and customer-centric claims experiences is no longer optional—it is a critical competitive differentiator in today’s healthcare insurance landscape.

Read More - https://www.insurancethoughtleadership.com/customer-experience/why-claims-experience-real-differentiator

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Standardize Insurance Processes with Custom Software Implementation

The fundamental advantage of custom insurance industry software lies in their perfect operational fit. These solutions mirror exactly how an insurance company conducts business, from underwriting procedures and policy administration to claims processing and customer management. This alignment eliminates the inefficiencies and workarounds that plague standardized software implementations.

Read More - https://dev.to/elledsouza/custom-vs-out-of-the-box-insurance-software-solutions-which-choice-helps-insurers-win-5be2

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

How AI Is Transforming Traditional Claims Adjusting

AI is reshaping the way claims are handled — automating repetitive tasks, improving accuracy, and empowering adjusters to focus on complex decisions. With technologies like machine learning, NLP, and advanced image analysis, insurers are seeing faster claims resolution, stronger fraud detection, and better customer experiences. AI isn’t replacing humans — it’s enhancing their capabilities and driving efficiency across the claims lifecycle.

Read More - https://www.damcogroup.com/blogs/how-ai-is-transforming-traditional-claims-adjusting

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

The Future of P&C Insurance in 2026

The P&C insurance industry is entering a new phase of digital maturity, driven by rapid advancements in technology and evolving customer expectations. This technology-led outlook explores the critical strategic shifts insurers must adopt to modernize core operations, improve underwriting and claims efficiency, strengthen data-driven decision-making, and deliver more transparent, customer-centric experiences. It also highlights how embracing automation, advanced analytics, and scalable digital platforms will be essential for building trust, improving agility, and sustaining long-term competitiveness in 2026 and beyond.

Read More - https://dgmnews.com/posts/whats-next-for-pc-insurance-in-2026-a-technology-led-industry-outlook/

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Key Technology Trends Transforming the Life Insurance Industry

Technology transforms life insurance—AI, automation, and data analytics streamline operations, improve underwriting, and enhance customer experiences, helping insurers stay competitive in a digital-first world.

Read More—https://www.damcogroup.com/blogs/key-technology-trends-transforming-life-insurance-industry

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Why Agentic Automation Is the Next Big Leap in Insurance Software

Traditional rule-based automation is no longer enough for modern insurers. Agentic automation embeds autonomous AI agents into insurance software to understand context, make decisions, and orchestrate end-to-end workflows across underwriting, claims, policy servicing, and customer engagement. Discover how this advanced approach enhances efficiency, accuracy, compliance, and the overall customer experience across every line of business.

Read More—https://thebossmagazine.com/post/insurance-software-agentic-automation/

Lean More - https://thebossmagazine.com/post/insurance-software-agentic-automation/

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Automate Policy Administration Processes with Cloud-Based Software

Do you think modernizing insurance operations requires massive system overhauls? Cloud-based policy administration systems prove otherwise. These platforms modernize core insurance processes without disrupting existing workflows. Cloud technology reshapes how insurers execute daily policy operations. The real value lies in the ability to automate manual processes and eliminate operational bottlenecks that slow down business growth.

Read More—https://dev.to/elledsouza/what-makes-cloud-based-policy-administration-systems-different-from-on-premises-tools-1he1

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Meet Regulatory Conditions with Insurance Compliance Management Software

Insurance companies that embrace automation gain resilience against evolving regulatory requirements. These organizations respond faster to compliance changes and maintain consistent practices across all operations. Manual approaches become increasingly unsustainable as regulatory complexity grows. Insurance compliance management software represents more than technology adoption; it enables fundamental business transformation.

Read More - https://datafloq.com/automated-compliance-software-for-insurance-simplifying-audits-and-building-trust/

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Overcome Extensive Infrastructure investments with Best P&C Software

The challenges faced by small carriers are real — limited resources, constrained budgets, and legacy system dependencies. However, the best P&C insurance software solutions address these constraints effectively. Cloud-based platforms eliminate prohibitive upfront costs while delivering enterprise-grade functionality through subscription models. Carriers with modest IT budgets can access sophisticated tools without extensive infrastructure investments.

Read More - https://www.linkedin.com/pulse/how-best-pc-insurance-software-enables-small-sized-carriers-alice-leo-dslwe/

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

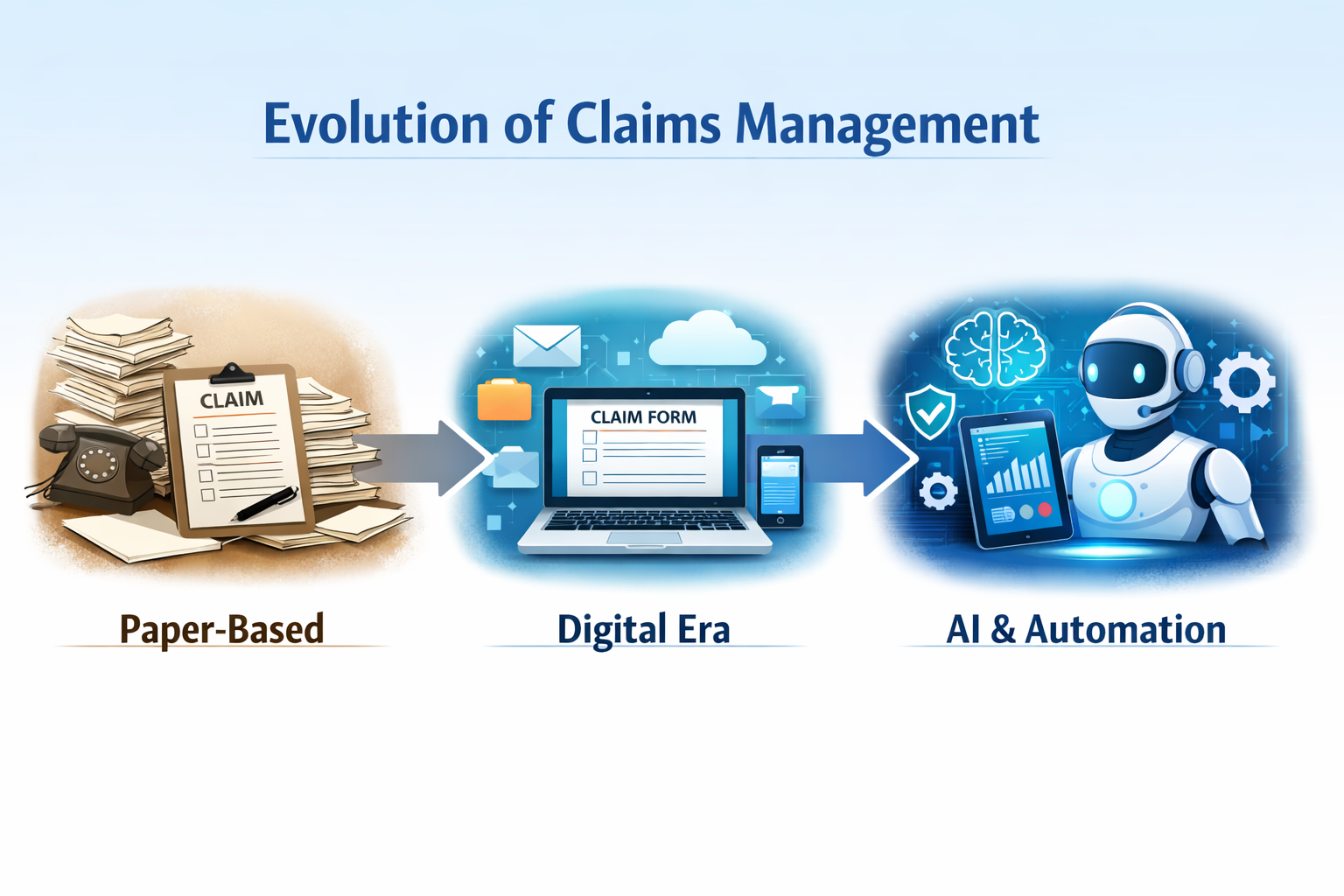

Evolution of Claims Management in Insurance

Explore how the insurance industry is transforming with the evolution of claims management. This insightful blog by Damco Group highlights the shift from manual processes to automated, tech-driven systems—enhancing efficiency, accuracy, and customer satisfaction. Discover key innovations shaping the future of claims handling and why modernization is essential for insurers to stay competitive.

Read More—https://www.damcogroup.com/blogs/evolution-of-claims-management

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Claims processing success depends on customer trust. Policyholders expect clear explanations when filing claims, especially during stressful situations. Explainable AI insurance claims processing software delivers this transparency while maintaining processing efficiency. These systems enhance human decision-making rather than replacing it, giving adjusters the tools they need to make consistent, defensible choices.

Read More - https://www.insurancethoughtleadership.com/ai-machine-learning/claims-processing-requires-explainable-ai

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Insurance Claims Management Software—Streamline Your Claim Process

Discover how insurance claims management software can help insurers efficiently handle claims from submission to settlement. Automate workflows, reduce manual effort, minimize fraud, and improve policyholder satisfaction with a powerful, all-in-one solution.

Read More - https://www.damcogroup.com/insurance/claims-management-software

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Simplify Insurance Document Management with Policy Administration Software

Document automation represents a significant opportunity for insurance companies seeking operational efficiency and competitive advantage. Manual document management continues to hinder insurance operations through bottlenecks, errors, and compliance risks. Insurance policy administration software with document automation capabilities addresses these challenges while positioning insurers for sustainable growth.

Read More—https://community.nasscom.in/communities/digital-transformation/role-and-value-document-automation-policy-administration

Know More—https://www.damcogroup.com/insurance/policy-management-software

Simplify Insurance Document Management with Policy Administration Software - PromoteProject | Startup Growth Platform

Document automation represents a significant opportunity for insurance companies seeking operational efficiency and competitive advantage. Manual document management continues to hinder insurance operations through bottlenecks,... - Startup growth insights and entrepreneurship tips.

https://www.promoteproject.com/article/205937/simplify-insurance-document-management-with-policy-administration-softwareMark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

How AI Powers Policy Management Software

AI is transforming policy management software by automating critical processes, increasing accuracy, and boosting efficiency. Machine learning algorithms analyze vast datasets to streamline underwriting, detect fraud, and ensure compliance. AI-powered chatbots and virtual assistants enhance customer interactions by providing instant support and personalized recommendations. Predictive analytics enable insurers to assess risks more effectively, optimizing policy pricing and claims processing. By integrating AI into policy management software, insurers can lower operational costs, enhance decision-making, and deliver a seamless digital experience to policyholders.

Read More—https://www.insurancethoughtleadership.com/ai-machine-learning/ai-revolutionizes-policy-management-software

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

UAE Insurer Transforms Policy & Claims Operations with InsureEdge

Discover how a leading UAE insurer streamlined policy administration and claims processing through automation, improving efficiency, accuracy, and operational agility with InsureEdge.

Read More - https://www.damcogroup.com/client-success/uae-insurer-automated-policy-claims-with-insureedge

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

The Technology Shift Every Insurance Broker Needs to Know About

Explore the innovations reshaping insurance brokerage operations. From intelligent automation that reduces underwriting time to modular platforms that grow with your business, this blog explains why adopting broker management software today is essential for remaining competitive and delivering exceptional client experiences.

Read More - https://www.europeanfinancialreview.com/how-insurance-broker-management-software-can-supercharge-your-productivity-in-2026/

Explore More - https://www.damcogroup.com/insurance/brokeredge-broker-management-software

Insurance Broker Management Software Boosts Productivity - The European Financial Review

Discover how insurance broker management software improves efficiency, automation, and productivity for brokers in 2026.

https://www.europeanfinancialreview.com/how-insurance-broker-management-software-can-supercharge-your-productivity-in-2026/Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

InsureEdge: A Modern Insurance Management System for Digital Insurers

InsureEdge is a comprehensive insurance management system designed to streamline core insurance operations with automation, real-time visibility, and scalable digital workflows. It helps insurers improve efficiency, maintain compliance, and deliver faster, more consistent experiences across the insurance lifecycle.

Read More - https://www.damcogroup.com/insurance/insureedge-insurance-software

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Improve Policy Personalization Effectiveness with Insurance CRM Software

Risk assessment tools enable brokers to match specific client needs with appropriate coverage options. CRM for life insurance agents excels at tracking individual health profiles and life changes that affect insurance requirements. This detailed client knowledge eliminates generic policy recommendations that fail to address unique exposures.

Read More - https://completemarkets.com/Article/article-post/2794/How-Risk-Assessment-Tool-in-Insurance-Broker-CRM-Improves-Quoting-Precision/

Explore More - https://www.damcogroup.com/insurance/crm-software

Mark is an InsurTech enthusiast who likes to stay ahead of the latest technological trends that are impacting the insurance industry.

Top 5 Insurance Technology Trends to Watch in 2026

Insurers are set to modernize their day-to-day operations across the entire value chain. AI and cloud technology will be the biggest enablers. Here’s why:

- 40% of insurers will digitize operations by 2027 (KPMG)

- Cloud spending will hit 72% by 2029 (Gartner)

- 48% have adopted AI for customer interactions, 29% planning to adopt soon (KPMG)

Yet, many insurers haven't moved past POCs.

This blog breaks down the 5 market trends shaping the insurance ecosystem in 2026. Plus, recommendations on how to prepare for what's coming.

Read blog—https://www.damcogroup.com/blogs/trends-to-watch-in-insurance-outlook